Economy of Alaska

GDP

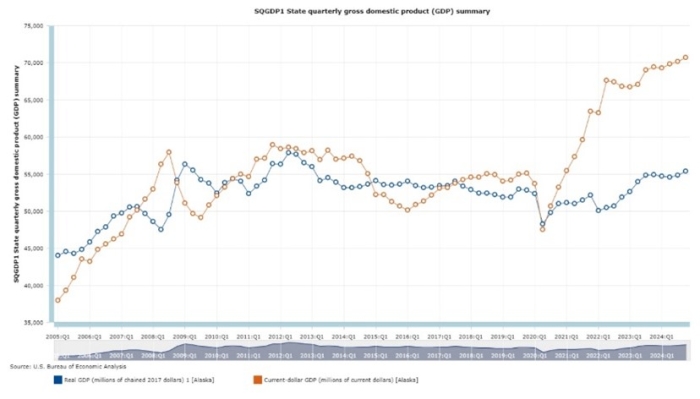

Alaska’s total GDP at the end of 2024 was $70.7 billion, a significant record, but given inflation its real GDP was $55.4B gradually increasing over the last two years. Alaska’s real GDP showed most recently a 4% (by quarter compounded annually) increase placing it 48th in real GDP, and 3rd in last quarter growth nationally sustaining a mostly positive trend since Q2 2022. Many factors contributed to the decline that began in 2012, notably oil price collapses, housing bubbles popping, the Covid-19 pandemic, and advancing technology as Alaska’s infrastructure lagged behind the rest of the U.S. The last two years of growth can be attributed significantly to advancing infrastructure developments throughout the state.

COL

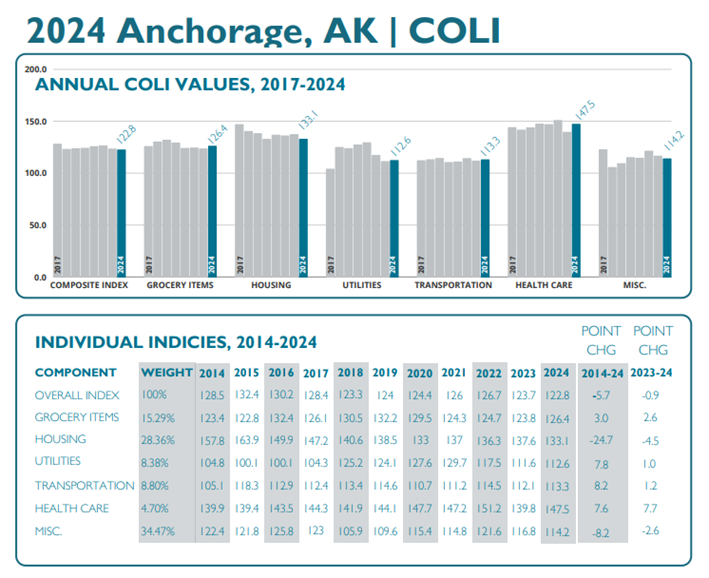

Alaska’s GDP per capita income is also lower than the national average because of the high commodity prices. As Alaska has minimal local manufacturing or farming production most of its goods must be shipped in. Anchorage, which pays the lowest overall consumer prices in Alaska, has a Cost of Living of 22.8% higher than U.S. averages and has been normalizing towards U.S. averages slowly. Alaska ranks highest among the states for total annual food costs, and healthcare costs.

Source: AEDC 2024 year end report Anchorage, Alaska Cost of Living Index

Economic Drivers

Military activity given Alaska’s strategic location has long been a boon to local economies in Anchorage, Fairbanks, and in certain remote communities. Alaska also boasts a unique tourism sector, that has seasonality challenges. Its industrial outputs are crude petroleum, natural gas, coal, gold, precious metals, zinc, other mining, and seafood processing. Oil from the North Slope has of course played an extremely impactful role in the development of the states budget and therefore activities across the state.

Export Import Dynamics

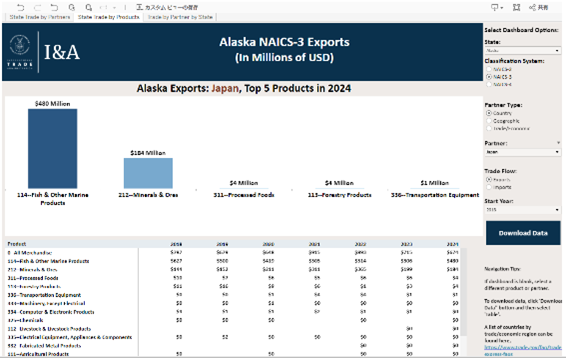

In 2024, Alaska exported $5.93B in products. In 2024 the top exports of Alaska by NAICS-3 classification were Fish & Other Marine Products ($2.09B), Minerals and Ores, ($1.96B), Primary Metal Manufactures ($1B), Oil and Gas ($0.38B), and Transportation Equipment ($0.15B). Primary Metal Manufactures has seen the most significant increase over the last few years. Gold, Airport parts, and Rice specifically were notable for unusual export growth thus far in 2025. In 2024 the top export destinations of Alaska were China ($1.51B), Australia ($0.82B), Japan ($0.67B), South Korea ($0.63B), and Canada ($0.61BM). Its fastest growing export destinations in 2024 compared to the preceding year were, Australia, Switzerland, and Hong Kong. Meanwhile its fastest declining export destinations were Germany Japan and Chile.

In 2024, Alaska imported $3.63B in products. In 2024 top imports of Alaska by NAICS – 3 classification were Petroleum & Coal Products ($1.46B), and Computer & Electronic Products ($0.9B), followed by Oil and Gas, Machinery except Electrical, Transportation Equipment, and Primary Metal Manufactures. In 2024 the top import origins of Alaska were South Korea ($1.17B), Canada ($1.02BM), Vietnam ($0.3B), Thailand ($0.26B), and Argentina ($0.12B). Fastest growing import origins in 2024 were Canada, Vietnam, and Thailand, with the fastest declining South Korea, Japan, and Mexico.

Most recently reported in March 2025 Alaska exported $533M and imported $197M, resulting in a positive trade balance of $340M. Between March 2024 and March 2025 Alaskan exports increased $111M(26.3%) from $422M to $533M, while imports decreased by -$106M(35%)from $303M to $197M.

Tradestats from the U.S. International Trade Administration

Additional Source: Export statistics from the Observatory of Economic Complexity

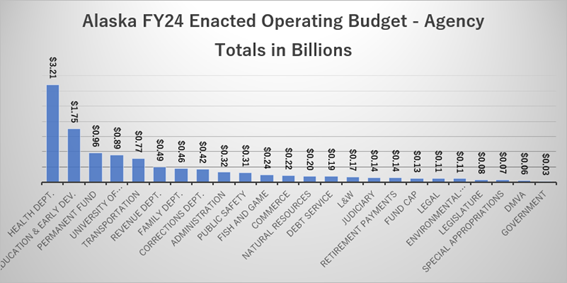

State Budget

Since 2012 Alaska’s state budget has operated in a deficit, averaging around $1 Billion annually. Much of the states budget was highly dependent on resource extraction, particularly oil, and as oil prices fell in 2012 so too did Alaska’s budget deficits increase. Wartime has increased oil prices creating in 2022 and 2023 a brief budget surplus of around $3.4 billion. Declining oil prices have again created a significant deficit. Alaska also receives significant federal funding for a large portion of its annual budget specifically in health and education.

Source: Alaska Division of Legislative Finance FY2026 Gov. Proposed Budget

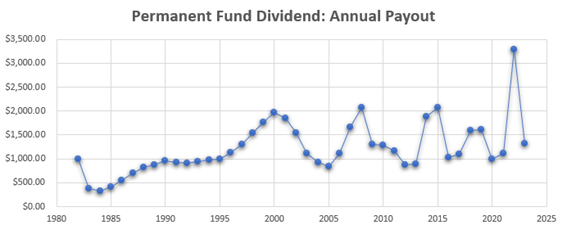

Alaska PFD

Alaska possesses a unique form of Universal Basic Income called the Alaska Permanent Fund, which came into law in 1976 via a constitutional amendment Article IX, section 15. Which initially took 25% of all resource based proceeds and allocated them to an income producing investment fund. The APFD pays to all qualifying Alaska residents an annual dividend with varying amounts depending on economic and political circumstances. In 2018 a law was passed that allowed the state to dip into the constitutionally protected permanent fund that today sits with over $56.7 billion in principle alone. Today Alaskan politicians hotly debate use of the fund to cover deficits in the state budget and the 2025 PFD payout appears to be set at $1000.

Graphic Source: Consular Office of Japan in Anchorage, Alaska; Data Source: pfd.alaska.gov

https://pfd.alaska.gov/Division-Info/Summary-of-Dividend-Applications-Payments

Economic Outlook

Alaska’s economic health is highly dependent on its success in bringing large resource extraction projects (LNG, Oil, or Critical Minerals) into operation or establishing alternative means of revenue through one, or many, of its other valuable economic sectors such as tourism.The seafood industry is currently facing serious turmoil requiring significant adaptation in the wake of the China trade wars, Russian war financing through overfishing, and climate impacts. Various projects throughout the state have potential to bring wealth back if they can receive necessary initial investments to become operational. Alaska LNG currently is experiencing higher support than ever before, and a potentially emerging data center sector may encourage further energy development and therefore economic growth.

External Data Sources

GDP Source Bureau of Economic AnlaysisInternational Trade Administraton Import/Export

Export Sources Observatory of Economic Complexity

COL Sources: AEDC COL indexes

PFD Sources: Alaska Permanent Fund

Alaska Legislative Finance Division